We spent a Tuesday afternoon talking to Stephen Wall, Co-founder of The Wealth Mosaic, looking at the wealth management sector’s past, present and future. Our CEO Luc got to talk about the ‘New Normal’, had the chance to give an insight into where Unblu is heading and how we support this evolving sector.

See this week’s top picks from the interview below.

Stephen: Obviously, wealth management deals with different segments of clients from retail through to family offices with high net worth, UHNW, mass affluent, with different propositions, discretionary advisory, execution, etc. Do you fit best in a certain area here?

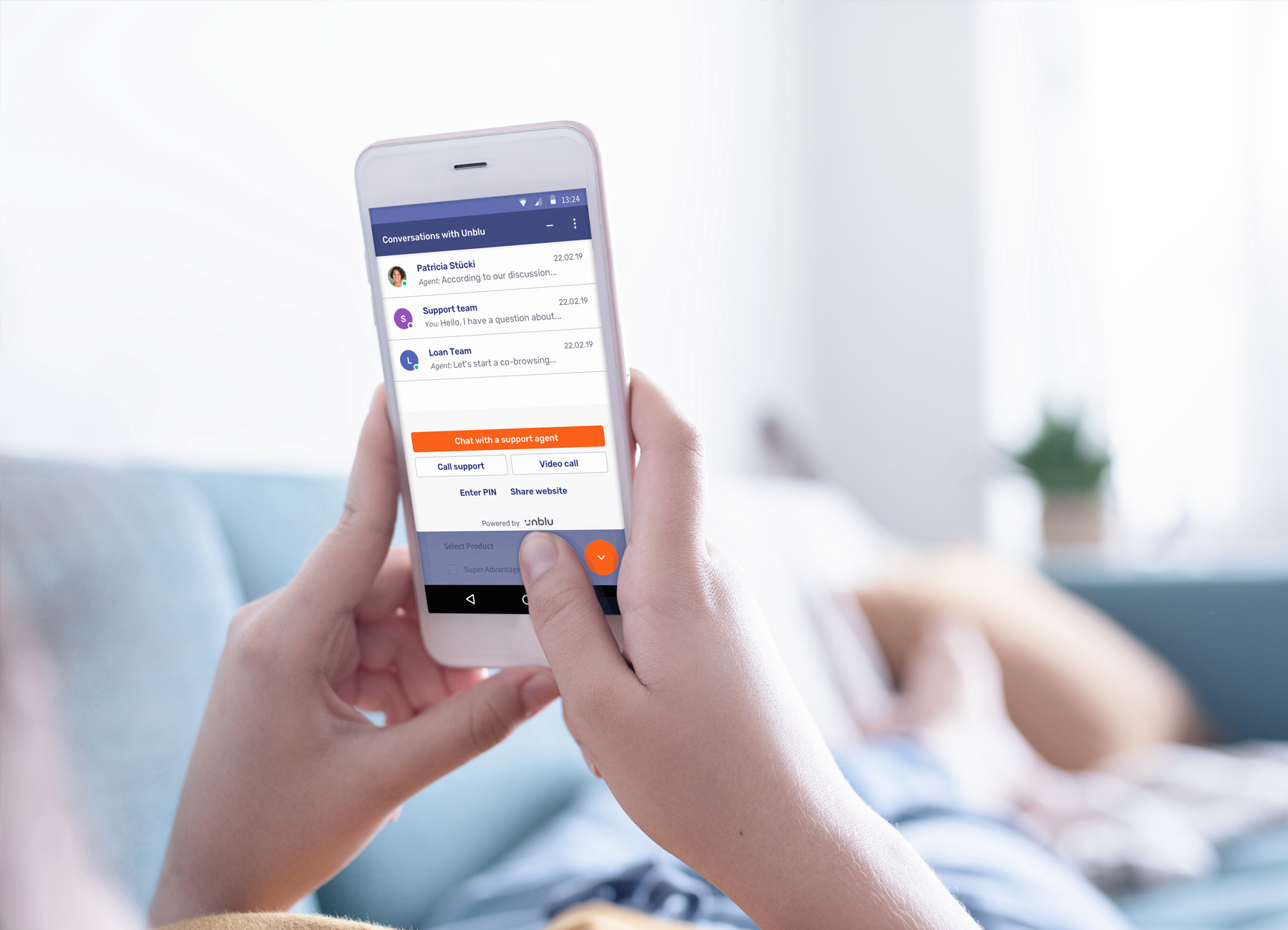

Luc: We fit in as long as there is a certain touch of advisory. Not just pure messaging, but the bank really wanting to have the possibility to advise customers. With retail, it might be a loan, a mortgage. But with Ultra High Net Worth Individuals it’s another level of financial sums and wanting to build genuine, trusting relationships, right? So Unblu is really for all customer segments. Thanks to our features such as Secure Messenger, Co-Browsing and Video & Voice, we make seamless investing a reality, so that you really have the appropriate type of interaction, dialogue and collaboration with your customer.

Stephen: Can you give us a little bit of a perspective on the way you think technologically the private banking wealth sector will be in 5 years time, what tools will look like and what they’ll enable?

Luc: We definitely see mobile experience overtaking the desktop usage (when you think of portfolio reviews i.e.). We’re seeing customers getting even more digital and wealth managers are becoming bionic. They are embracing technology. And that’s not a replacement, but really a supporting technology. This could be as simple as an address change or a more complex trading bot, with the human advice coming in whenever needed. So a lot of things are going to get strongly automated. And I think that’s probably the biggest change that we’re seeing: going mobile, going digital and automation.

Stephen: And finally: Unblu’s own journey over the next five years? The industry will evolve – what are you going to be doing to support that and to push your firm forward?

Luc: Unblu is continuously globally expanding and we’ll be guiding financial institutions into this rapidly changing future. We’re seeing ourselves as the facilitator, helping them transition into these bionic relationship managers. We’ll support wealth management firms by helping them move into that digital space, enabling meaningful conversations between financial service providers and their customers.

Tune into the whole WealthTech Talk here or learn more about our hybrid approach for building a trusted relationship within the wealth management sector.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice