Choosing a mortgage lender is a big decision and customers are most likely to go with a lender who they already trust and who prioritizes their needs. Yet despite an inferior customer experience compared to non-banks, banks still capture about 75% of the first-time buyer market.

How long can this last? Customers are getting used to fast, transparent, convenient, and personal digital experiences outside banking. Soon they’ll be demanding the same from their financial provider too.

While advances in technology initially appear to be an advantage for customer service, there are downsides to the shift towards online interactions. While digital customer experiences can be more efficient and convenient, they often lack the vital human element of empathy. In the bid for ever faster and more cost-efficient business operations, finance firms that claim to be customer-centric have a tendency to neglect the customer’s needs for reassurance, familiarity, and a personalized experience. As a result, they lose customer trust and loyalty.

Show you care to build trust and secure loyalty

COVID-19 has accelerated the digitization of the customer experience. But as digital becomes the channel of choice for customers, banks need to ensure that they continue to feel valued, appreciated, and respected in every online interaction.

Empathy-driven customer experience offers advantages for providers. In fact, according to Forrester, among customers who feel valued by their bank, 71% plan to stay with that bank, while 87% will advocate for it, and 82% plan to spend more money.

And so delivering a convenient solution is only half the story when it comes to generating loyalty. The mortgage decision-making process depends on this empathetic approach as much as it does on efficiency and speed.

Banks must leverage ‘moments of truth’, stepping in at the moment that a customer needs them with relevant and personalized help, proving their value as a provider. This establishes trust from the first instance. If customers can count on their bank to deal with relatively minor financial queries positively, they can depend on them for their mortgage later on. By delivering an exceptional service early on, providers are paying upfront for the chance to be at the top of the customer’s list when it comes to looking for mortgage providers years later.

Leverage the ‘moment of truth’

Digital tools provide both speed and convenience and a personalized experience.

On the one hand, customers want to communicate with their bank in the way that best suits them in that instant. Perhaps they only have time to send a quick text on the go. Or maybe a video call is preferable to coming into the branch.

On the other hand, customers want to feel that they are being treated as an individual rather than dealing with a one-size-fits-all approach.

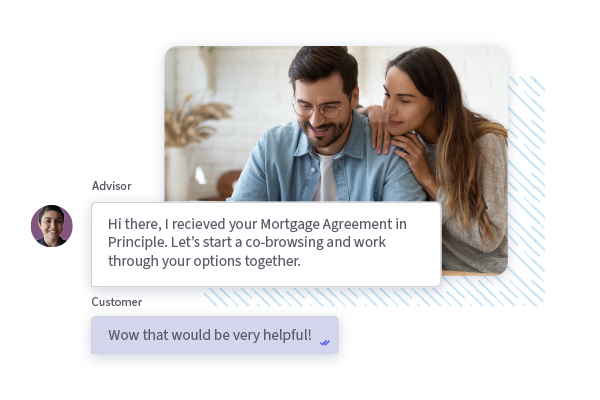

Using diverse digital tools incorporated into a seamless customer journey, banks can offer customers choice and flexibility. Video chat provides reassurance. Co-browsing allows for collaboration. And rather than isolated touchpoints, each interaction is part of a greater whole. Advisors have access to the conversation history and any shared documents so they’re always up to speed on the customer’s needs.

Taking out a mortgage is a big decision—and one with emotional significance. Customers need to trust their bank. This depends on them having a positive experience from the get-go. For example, a customer might first open an account with their bank at the age of 18. If they have a great experience each and every time they then need something from their provider, when it comes to taking out a mortgage twenty years later, they are going to feel much more confident in their decision.

Establishing trust from the outset is like an investment that pays off later down the line. And so customer-centric mortgage advice means not only using digital tools to speed up and streamline the mortgage process but also to provide meaningful and reassuring support that makes customers feel heard and valued.

Digital Advice and Unblu

Meet the customer on their terms and show them that you care with Unblu. Our range of digital tools make every conversation count. Find out more by booking a demo today.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice