In today’s changing customer landscape, insurance providers understand the imperative to digitize their services. However, in the bid to develop a digital customer experience, they encounter problems. They want to use tools like chatbots to reduce the time taken to resolve problems and increase customer satisfaction and loyalty to their brand. But they frequently fail to fully consider the journey from the customer’s perspective, not realizing that an enjoyable online experience is one that is adaptable.

Chatbots can indeed reduce resolution times. But customers may still want the opportunity to speak to a human advisor at times. For this reason, insurers need to realize the need for a hybrid digital experience. One that merges self-service technology with human operated digital channels so customers could transfer from a bot to speaking to a real person whenever they wanted.

Chatbot use case for self-service

If a customer wants to update their address on their insurance company’s app, for example, they could get instructions via a chatbot 24/7. Rather than searching FAQ pages, they can get a fast answer in the intuitive form of a conversation.

With advisors able to delegate these simple queries to chatbots, insurance companies can save time and money. Meanwhile, customers are satisfied that they can get a quick answer, which in turn improves brand loyalty.

Chatbot use case for instant customer support

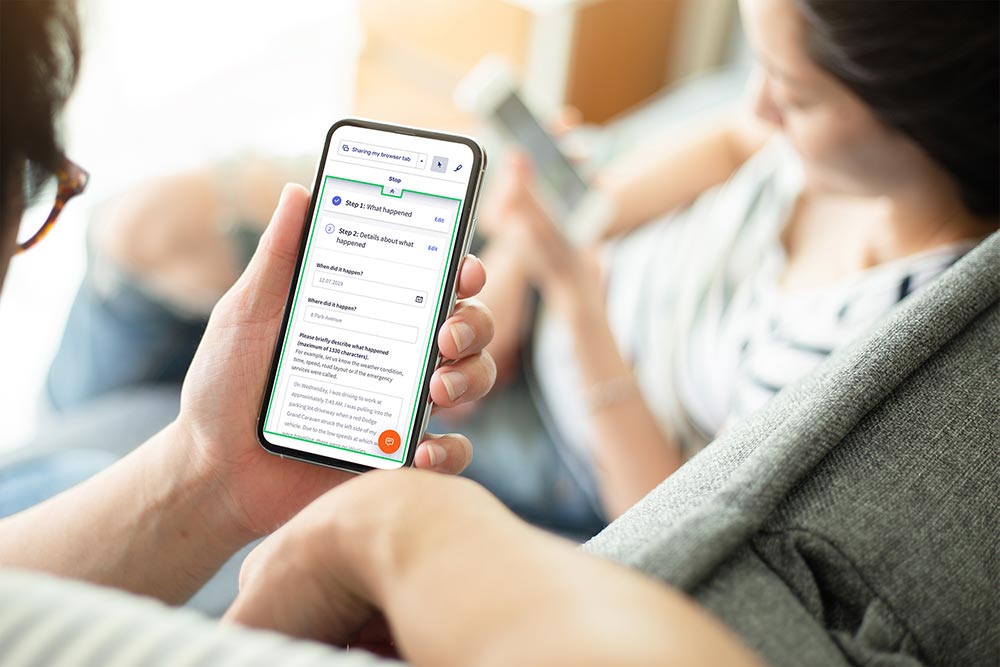

Customers want to be able to access claim updates instantly, wherever they are, on any device, whether it’s via text message or on an app. Customer preferences are always changing so insurers must create a customer journey that can adapt as needed.

By combining different digital tools into a seamless but flexible customer journey, insurers can save time through improved efficiency, boosts customer satisfaction, and yield savings of 15% to 25%. By evolving alongside the customer, they are always one step ahead.

Chatbot use case for insurance advice

For advice on insurance products, chatbots provide the ideal first port of call. They can ask visitors the relevant questions before transferring them to an advisor who can then use tools like co-browsing, live chat and video chat to further enhance the conversation.

Customer support teams therefore save time without taking any risks. The initial stages of the customer journey are handled by a chatbot but the option to transfer to an advisor at any time means no danger of the customer abandoning.

Chatbot use case for sales lead generation

Chatbots can also be used to increase lead generation. When a prospect lands on a high-intent page where conversions are likely – such as the insurance product page – the bot can start the onboarding process, scoring the leads and asking them if they’d like to speak to a specialist.

This is a low-cost way to boost lead generation. Plus, by offering help at the moment of truth – exactly when the customer needs it most – insurance companies can increase the chance of conversion.

Chatbot software integration & Unblu

Unblu’s chatbot software creates a hybrid customer experience by allowing for an effortless pivot between bot and advisor, offering customers the efficiency of high-tech solutions and the reassurance of a traditional human-to-human exchange.

Find out how Unblu’s chatbot technology could transform your customer journey by booking a demo and we will reach out to help.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice