Financial planning is painful. According to a recent survey, Americans often find financial planning as difficult as training for a marathon. Based on their survey responses, they are certainly open to technology helping them out. More individuals say they would rather choose tech for help with managing their money, over using it to have their food delivered, find a date, diagnose a health issue or drive a car.

The good news is that technology is changing the way money is managed, allowing customers to oversee their finances from their tablet or mobile with just one touch. But when it comes to their overall financial plan, many still want that human touch. Of the 1,000 individuals surveyed, 86 percent said they still want to be able to interact with a person, and 43 percent said they prefer human help over automation for even routine daily financial tasks. At the same time, 43 percent of baby boomers prefer technology over people for help with solving their financial problems.

86% of people want to be able to interact with a person for financial planning

Robo-advising has its limitations

It’s easy to see why robo-advisors have a place in the market. Microprocessors have reengineered many industries and made them more efficient, productive and appealing to the consumer. But good financial advice depends on things that are beyond a robotic capacity, such as intellectual capital, nuance and emotional interactions. Like other sectors of the industry, wealth management is grappling a major question: What should be automated by robo-assisted services and what should be left for human expertise to best service clients?

Most experts agree that it has to be a blend of both human and automated help – melding powerful technology with guidance and expertise of an advisor. Robo-advisors can help both clients and wealth managers by distilling relevant information, making them both better prepared to collaborate and make decisions. While algorithms may do more of the investing work, people still want humans to help them plan their broad financial lives. Almost 50% of Generation X and Y respondents cited “developing a financial plan that structures my financial life” as an unmet need. This is where robo-advisors are limited. A robo-advisor can’t offer nuanced advice, or advise on complex life events or provide sophisticated tax planning.

The best of both worlds – a hybrid approach

A hybrid approach, according to Gregory Gatesman, the CEO of Julius Baer Group, can deliver the kind of transparent, personal advice investors are looking for. “We’re really trying to build a holistic, robust advisory process for our relationship managers,” said Gatesman in an interview with Forbes. “When you think of the amount of effort a bank and an advisor put in to prepare for an asset allocation discussion with a client, you can imagine the power and efficiency a robo-advisor can bring to an organization.”

Consumer research conducted by the Boston Consulting Group for its annual Global Retail Banking report found that 43% of respondents favoured a mix of physical and virtual interactions — in which digital tools and capabilities combine with human input and advice at the moments that matter. Furthermore, banks that augment human interactions with smart digital tools can expect to generate increased revenue while cutting costs significantly. According to BCG’s research, banks that adopt this hybrid approach can see revenue gains of 5% to 15%, network cost reductions of 15% to 35%, and increases in customer satisfaction of 10% to 15%.

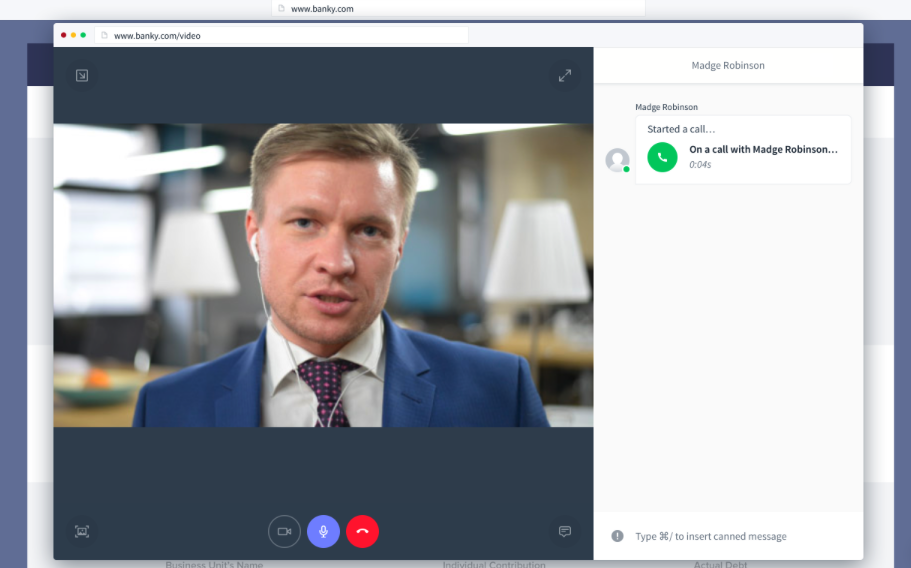

A bionic approach makes human conversation available for every online interaction and on every channel. With a conversational interface, the customer experience can include texting, voice conversations, and video chat, alongside the digital tools of co-browsing and document sharing. This range of interaction re-creates a face-to-face bank branch meeting. The customer chooses how they want to interact and if they want human interaction, which is one click away.

Ultimately there is no replacement for the building a trusting relationship based on the very human aspects of needs, hopes and fears. When humanity and expertise is combined with technological capabilities, the financial advisor can provide truly holistic expertise.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice