Banks and financial service providers play a key role in the everyday lives of customers. From online banking to savings accounts to financial planning, customer service is an integral part of every interaction between businesses and consumers in the banking industry.

In the past years, we’ve seen the financial industry evolve dramatically with the advent of technology. This has put a lot more emphasis on digital channels and online banking. As a result, customer service executives have needed to adapt, finding ways to stay connected with their customers via remote banking options.

Nonetheless, there is still a clear in-person component to banking customer service. Bank branches haven’t ceased to exist, and bank tellers should still be able to handle basic situations like money transactions and account inquiries.

Whichever way they choose to engage, financial customers are looking for more than just somewhere to deposit checks or transfer funds when it comes to choosing their bank. They’ll want to see that their primary bank can provide them with different levels of service for various banking activities, as well as quality products.

As far as banks are concerned, an exceptional customer experience will increase loyalty among existing customers and attract new ones. That means it’s well worth investing efforts into customer service to add value to a financial services offering. We’ve outlined some pillars of great banking CX strategies to get you started.

1. Make a great first impression

Your first touchpoint is an opportunity to set the tone for a new customer relationship. If a customer is opening a checking account or signing on to investment products, this is likely to be an official onboarding process. However, onboarding sits at the crux of inefficiency for many banks. Due to large amounts of personal and legal data, it can take weeks to complete a process – especially when these are paper-based, manual processes.

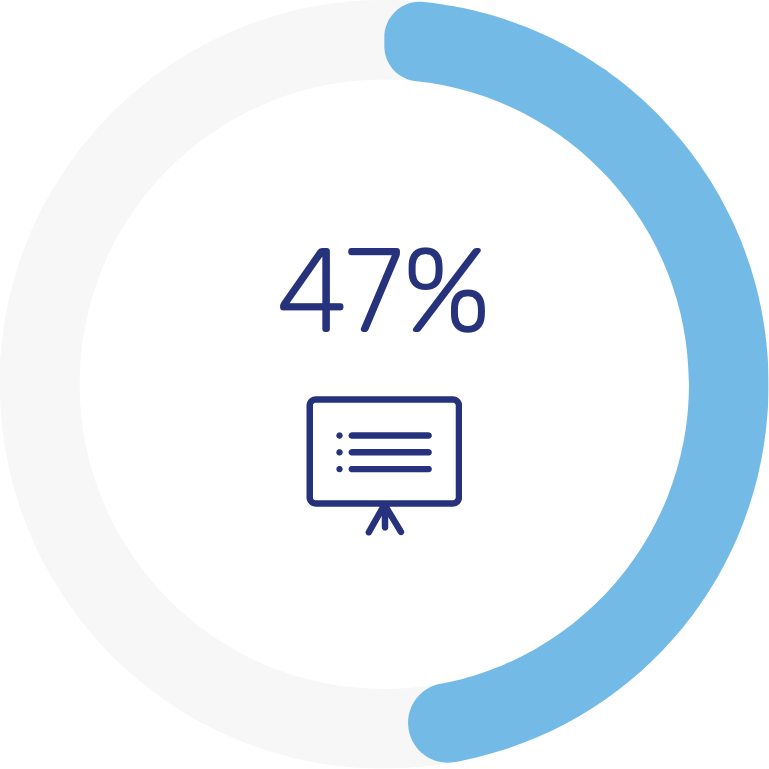

It’s vital that firms look for ways to optimize onboarding, but few are taking the steps to do so. According to The Digital Banking Report, a shocking 47% of organizations don’t have a formalized onboarding process. With a lot to gain from using the onboarding process to make a first impression, enhancing processes and service standards for this stage of the customer journey is likely to help banks stand out.

47% of organizations don’t have

a formalized onboarding process

2. Opt for positive language

Finances are often personal in nature, and can involve sensitive subjects. Therefore, using the right language when engaging with customers is vital. Customer service agents should aim to answer banking questions in simple language, offering the appropriate banking resources for any additional questions.

Language is also important when it comes to communications powered by artificial intelligence. If a bank uses chatbots to respond to certain customer requests, these interactions should also reflect the tone and attitude of a human customer service agent.

The best rule of thumb is to focus on the positive. Bank employees or human agents should emphasize what is in their power to do and, if they can’t resolve a request instantly, assert that a resolution is on its way.

3. Empower advisors

In today’s banking landscape, the importance of trust can’t be underestimated. Building trust means showing the customer that they are being heard, but this also requires banks to equip their advisors and agents to deliver an exceptional customer experience.

Just as customers might encounter issues with protocols around credit cards or debit cards, customer service employees run into problems when they can’t resolve a customer request due to company procedures and regulations. By listening to agents and giving them what they need, banks can empower customer service staff to solve problems on the spot. Banks should encourage them to make informed decisions that resolve issues, without having to get a manager’s permission first.

4. Choose your expertise

Innovative uses of technology have raised the bar for customer expectations. In today’s market, they want tailored advice to be accessible at any time.

That said, trying to provide quick and personalized guidance on all banking products is inefficient. Without a clear strategy, this will lead to higher expenses and overworked advisors who are struggling to keep up with specific customer demands.

Therefore, a better approach is to streamline areas of expertise. Banks can train advisors with specialized competencies (like mortgage applications or estate planning) and employ technologies like algorithmic banking to help them serve customers better.

Technology can also help advisors to reach customers more easily. Channels like video conferencing and live chat offer a quicker way to engage, as well as a convenient solution for many customers. Banks should invest in helping customers learn about new technologies to encourage digital uptake, but leaving the door open to in-person interaction is also key.

5. Customize the entire customer journey

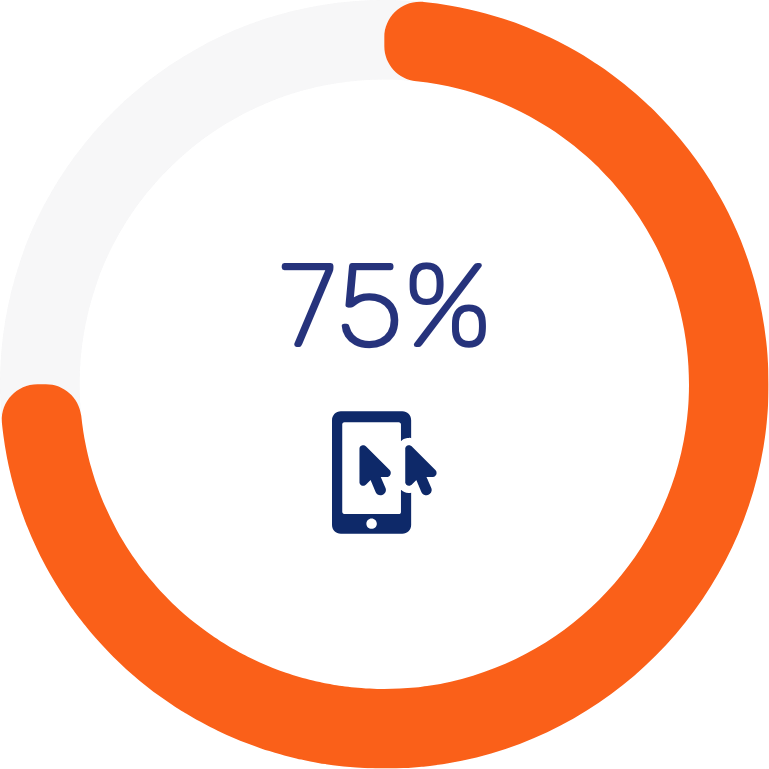

Technology offers banks ways to create a more customized customer journey. Many banks are leveraging the benefits of this, with 75% of financial organizations reporting that digital banking transformation is a top priority.

Online banking should be user-friendly and intuitive, but it’s also vital to offer multiple customer touchpoints and channels to engage with their banks on. These should be a mix of channels that are supported by mobile devices, as well as telephone services and video meetings for higher-touch interactions. Every banking journey will look slightly different, so it’s important to give customers flexibility to navigate evolving needs throughout the customer lifecycle.

75% of financial organizations

prioritized digital banking

transformation in the past year

6. Fuse technology with a personal touch

Younger financial services customers are the main advocates for personalized services. As a group that are accustomed to seamless and hyperpersonalized big tech digital experiences delivered by Apple, Google and Amazon, they expect the same from financial services providers. 81% of Gen Z customers say that personalized features would deepen their connection with their primary bank. For customers over the age of 65, a further 47% express this preference.

81% of Gen Z customers prefer personalized features for stronger bank connections

47% of customers over 65 share this preference

A growing number of customers are looking for a personal touch – and this is never more relevant than with the institutions they entrust with their money. Banks can meet both these demands by using technology to augment human expertise and build detailed profiles of customer preferences. Digital banking should aim to serve everyday needs while keeping customers connected to higher-touch engagements and personalized offers.

7. Build trust

People must be able to trust those in charge of their finances. In a world where victims of fraud often turn to their banks for help, the biggest driver of financial trust is assurance that banks are protecting customer data, with between 14% and 18% of all ages ranking this as the most important determinant of trust.

Banks must build robust internal systems for managing vast amounts of customer data, and stay transparent about how they are managing and processing personal information. With many financial institutions using third-party channels to communicate with the customer base, it’s also worth outlining what bank customers can do to keep their information safe. For instance, if sharing particular data such as an account number, social security number or PIN isn’t secure on certain channels, make sure this is obvious to customers.

8. Gather customer feedback

Feedback is fuel for customer experience teams. Without it, it’s very difficult to ensure excellent customer service in banking, and ratings provide valuable insights into the customers’ experience of financial services.

The issue is that customers are often reluctant to spend time giving feedback. Constantly hounding customers to log into an online portal and fill out a complicated form is unlikely to foster much customer engagement.

A better approach is integrating links to surveys in emails to customers. It’s best to keep these short and relevant, and ideally, they should offer some kind of incentive or reward for providing information. That way, feedback processes can be mutually beneficial.

9. Address your customers’ pain points

Unfortunately, the idea that one dissatisfied customer cancels out countless happy customers is no exaggeration. Knowing where you’re not delivering is a critical insight.

For many banks, the weaker points fall within digital service offerings, which are often newer additions to the customer experience. One survey showed that 64% of respondents felt that their mobile banking was inadequate for resolving customer queries quickly, sometimes failing to resolve them entirely.

Often, banks can rectify customer pain points by doing the basics well. The common frustration of a forgotten password is avoidable if banks are willing to invest in biometric technologies. It’s a small tweak that makes a huge difference to the overall customer experience.

Additionally, giving customers options for how they engage is likely to quell smaller issues. With collaboration tools such as live and asynchronous messengers, calls, and video meetings, banks can offer multiple paths to issue resolution. If the option for a conversation with a customer service team agent is there, people are likely to take it, which also helps to craft more meaningful interactions.

10. Focus on retention

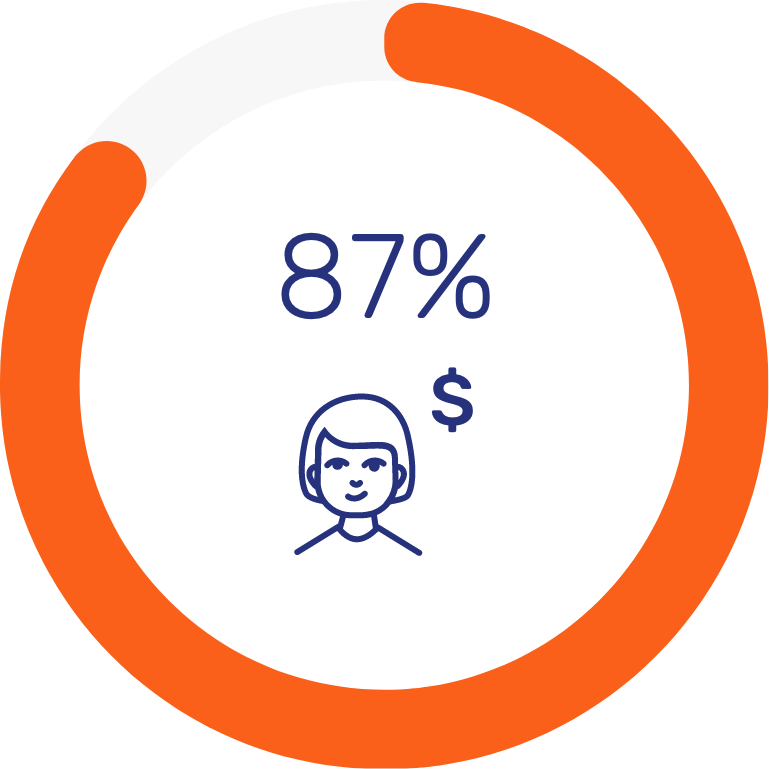

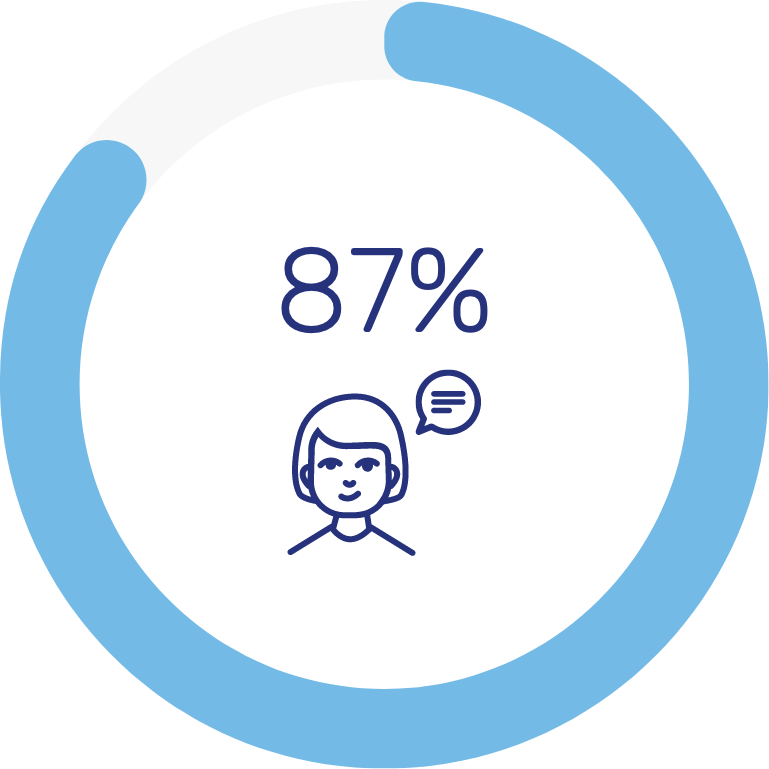

Customer loyalty is as important as new clients and a poor customer service experience can lead to high levels of churn. On the other hand, customers who feel satisfied with their experience will pick up momentum throughout the customer lifecycle, improving acquisition without any extra sales effort. Of customers who report feeling valued by their financial services provider, 92% plan to stay with the brand, 87% plan to purchase more, and 87% will advocate for the brand.

92% plan to stay with the brand

87% plan to purchase more

87% will advocate for the brand

So, what can banks do to improve customer retention rates? The research suggests that improving communication is a critical aspect – which also means expanding preferred channels on mobile apps and beyond. Digital self-service in online banking portals shouldn’t be the only exposure a customer has to their chosen financial institution. An omnichannel customer experience can help banks encourage the high-touch interactions that are likely to improve retention.

11. Put the customer first

Ultimately, exceptional customer service in banking depends on putting yourself in the customer’s shoes. New strategies should always start from the customer’s perspective, and this should be reflected in the indicators used. Focusing on average handle time (AHT) rather than customer-satisfaction scores, for example, puts the emphasis on productivity and costs rather than the overall customer experience.

Equally, customer-centricity won’t come without the right resources and workforce. Customer interests need to be represented at the highest level of an organization via Chief Customer Officer with direct access to the CEO. On the front lines, quality customer service agents and advisors should be properly trained and equipped with the right technology to deliver high-quality and relevant advice. The guiding service principle should always be putting the loyal customer’s needs over the financial services companies’ bottom lines.

Make every customer interaction count with Unblu

Unblu is a trusted technology partner of banking leaders worldwide, with over 160 deployments to date. Our conversational banking platform gives customer service agents and advisors the tools to deliver rapid, efficient, and personalized interactions. While fostering higher agent productivity and employee engagement, Unblu helps banks and industry leaders to deliver an unforgettable personalized experience that acquires and retains customers.

Want to find out more?

Reach out to us today for more information or to schedule a demo

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice